Texas Property Tax Code Updates:

Section 11.4391

HB 2228 amends subsection (a) to provide that the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under Tax Code Section 11.251 after the deadline for filing it has passed if it is filed not later than June 15 (rather than if it is filed before the date the appraisal review board approves the appraisal records).

Effective Jan. 1, 2018, and applies only to property taxes imposed

for a tax year beginning on or after the effective date.

Section 21.09

HB 2228 amends subsection (b) to provide that a person claiming an allocation must file a completed allocation application form before April 1 (rather than before May 1).

Section 22.23

HB 2228 adds subsection (c) to provide that notwithstanding subsections (a) and (b), rendition statements and property reports for property located in an appraisal district in which one or more taxing units exempt freeport property under Tax Code Section 11.251 must be delivered to the chief appraiser not later than April 1.

Section 41.44

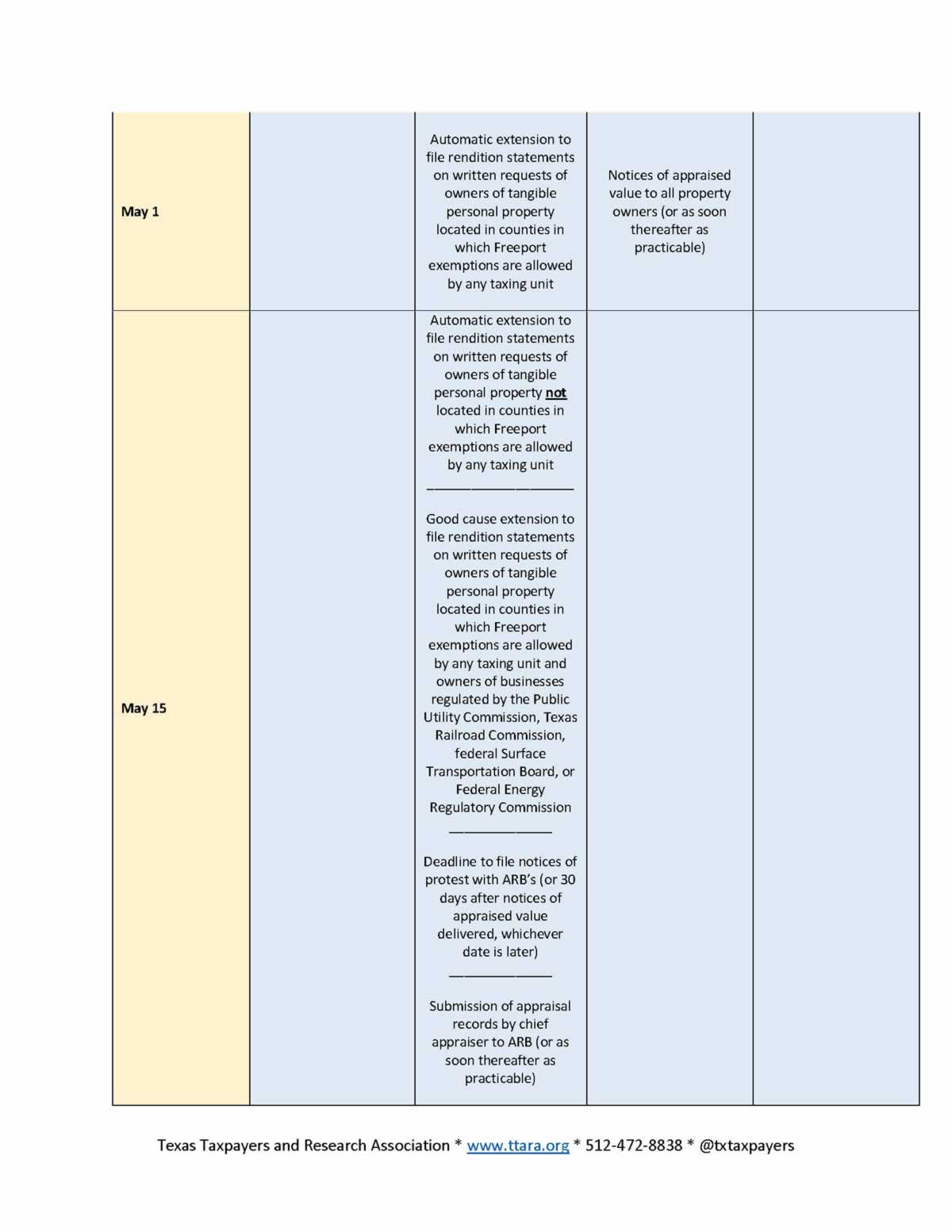

HB 2228 amends subsections (a) and (c) to modify the deadline for a property owner to file a notice of protest to not later than May 15 or the 30th day after the date that notice to the property owner was delivered to the property owner as provided by Tax Code Section 25.19, whichever is later (rather than before May 1 or not later than the 30th day after the date the notice was delivered to the property owner as provided by Tax Code Section 25.19, whichever is later).

Texas Binding Arbitration Changes:

The 85th Legislature made the following changes to binding arbitration laws effective Sept. 1, 2017.

- Senate Bill 731 raised the value of non-homestead property that is eligible to go to binding arbitration from a limit of $3 million up to a limit of $5 million.

- Senate Bill 1286 changed the selection process for arbitrators from property owner and appraisal district selection to Comptroller selection and restricted arbitrator eligibility.

- Senate Bill 1286 limits arbitration assignment to arbitrators living in the county of the arbitration and only opens an arbitration to statewide selection when a county does not have any residing arbitrators living in the county or when all residing arbitrators have declined a case.

- Senate Bill 1286 prevents arbitrators from being eligible for an appointment if, at any time during the preceding five years, they have represented a person for compensation in a Tax Code proceeding or have served as an officer or employee of the appraisal district or member of the appraisal review board (ARB) in the county in which the subject property is located.

Property Tax Bills:

This link will take you to a document published by Glenn Hegar, Texas Comptroller of Public Accounts. regarding the 83rd Texas Legislature, Regular http://www.window.state.tx.us/taxinfo/proptax/laws/96-669_2013.pdf

This publication includes highlights of recent legislation relating to property tax. The highlights are general summaries and do not reflect the exact or complete text of the legislation highlighted. Not all legislation impacting property tax is addressed. Please be advised that this information is being provided solely as an informational resource. The information provided is not intended for use in lieu of, or as a substitute for, the legislation referenced herein and should not be relied upon as such. Additionally, the information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should, as appropriate or necessary, be directed to an attorney or other appropriate counsel.

This session the Legislature enacted SB 1093, which amends numerous codes, including code sections contained in this publication, to codify laws without substantive change, appropriately renumber or reletter duplicate official citations, correct enacted codes to conform the codes to the source law from which they were derived, and revise codes or parts of codes enacted during the preceding legislative session. Law changes enacted by SB 1093 are not included in this publication.

The Texas Legislative Council periodically conducts revision of state law to codify statute. The Legislature enacted SB 1026 as part of an ongoing project of systematically codifying local laws concerning special districts. These law changes are not included in this publication.

The Texas Property Tax Code (Code) has been amended in several areas which might be noteworthy in considering your tax liabilities. For example, Chapter 23 of the (Code) has been amended in that appraisal districts must comply with the Uniform Standards of Professional Appraisal Practices (USPAP). Specifically, the Chief Appraiser must now consider the income, cost and sales comparable approach to value. This would apply to all tangible real and personal property. Furthermore, Section 41.43 has shifted the burden of proof, as it relates to tax value appeals, to the appraisal district. Failing to meet this burden could result in valuation appeals in favor of the protesting taxpayer.

The taxpayer should also be aware that certified assessments may be corrected after the June 1 appeal deadline. Sections 25.25 (c), (d) and (h) generally deal with late appeals as it relates to corrections of the appraisal roll (roll). Section 25.25 (c) deals with clerical errors, multiple appraisals, and property that does not exist in the form or location described on the roll. Said motion can be filed any time before the end of five years after January 1 of the tax year. Section 25.25 (d) must be filed prior to the delinquency date and it must be proven that the error on the roll exceeds by more than one third of the correct value. A successful appeal by a taxpayer will be assessed a 10% late correction penalty. Finally, a Section 25.25 (h) is a joint motion to correct the roll between the Chief Appraiser and the taxpayer, filed prior to the delinquency date. It should be noted that a successful filing of a (h) does not carry a 10% late correction penalty and should be filed in conjunction with a (c) to possibly avoid any late penalties. Using the three approaches to value i.e.: a personal property fee appraisal versus assessment derived strictly through the cost approach, could be very cost effective. Additionally, provisions to correct errors to the roll can also be very beneficial to taxpayers in conjunction with USPAP and correcting errors after the protest deadline.