We understand the challenges our clients face and we pride ourselves in providing expert property tax consulting services tailored to their business needs.

We provide the following services to our clients in a timely and professional manner:

- Assist client in developing long range property tax strategies and budgets.

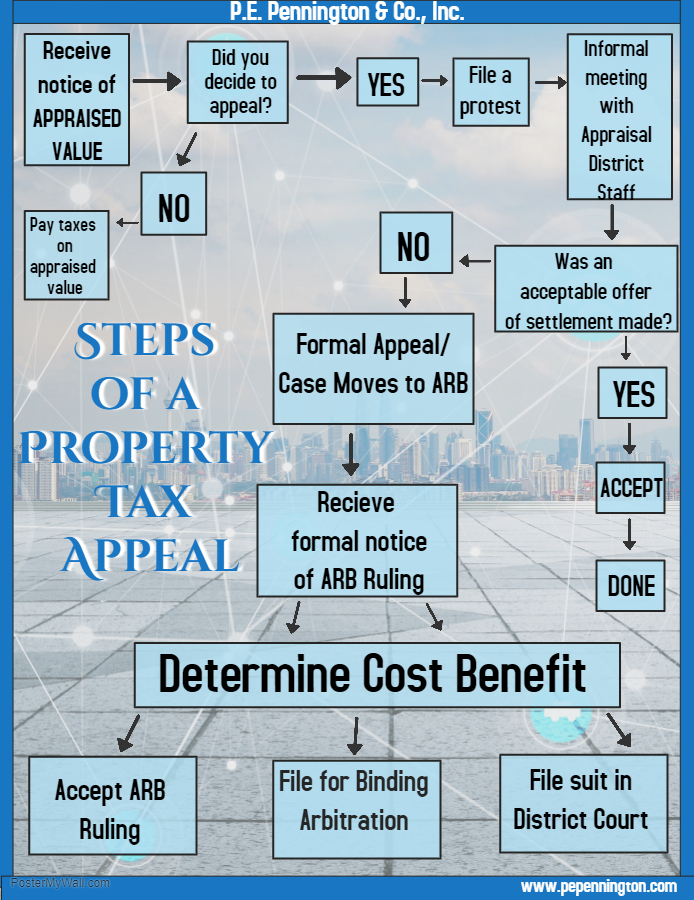

- Personal property filings and valuation appeals.

- Administer real estate valuation appeals including informal and formal board hearings.

- Litigation support.

- We provide property tax forecast.

- Acquisition and development property tax analyses.

- We audit and process tax statements for timely payment.

- We provide Ag Rollback analyses.

Legislative Services:

- We provide technical support in developing legislative agendas and vetting proposed legislation.