Tax Appeal Saving Examples by Category

Apartments Tax Savings

|

2023 Assessment Value |

$197,625,000 |

|

2023 Final Value |

$143,750,000 |

|

Market Reduction |

$53,875,000 |

|

Tax Savings |

$1,236,313.28 |

|

2023 Assessment Value |

$110,585,325 |

|

2023 Final Value |

$86,400,000 |

|

Market Reduction |

$24,185,325 |

|

Tax Savings |

$453,072.16 |

|

2023 Assessment Value |

$146,566,675 |

|

2023 Final Value |

$98,250,000 |

|

Market Reduction |

$48,316,675 |

|

Tax Savings |

$905,133.19 |

|

2023 Assessment Value |

$171,495,000 |

|

2023 Final Value |

$130,359,000 |

|

Market Reduction |

$41,136,000 |

|

Tax Savings |

$954,265.11 |

|

2023 Assessment Value |

$91,684,763 |

|

2023 Final Value |

$43,000,000 |

|

Market Reduction |

$48,684,763 |

|

Tax Savings |

$980,905.95 |

|

2022 Assessment Value |

$79,405,580 |

|

2022 Final Value |

$45,615,670 |

|

Market Reduction |

$33,789,910 |

|

Tax Savings |

$891,374.78 |

|

2022 Assessment Value |

$32,703,200 |

|

2022 Final Value |

$10,500,000 |

|

Market Reduction |

$22,203,200 |

|

Tax Savings |

$562,518.08 |

|

2022 Assessment Value |

$99,900,000 |

|

2022 Final Value |

$86,000,000 |

|

Market Reduction |

$13,900,000 |

|

Tax Savings |

$370,155.75 |

|

2022 Assessment Value |

$55,735,154 |

|

2022 Final Value |

$36,700,000 |

|

Market Reduction |

$19,035,154 |

|

Tax Savings |

$439,204.58 |

Assisted Living Tax Savings

Banks Tax Savings

Condos Tax Savings

Events Facilities Tax Savings

Hotel Tax Savings

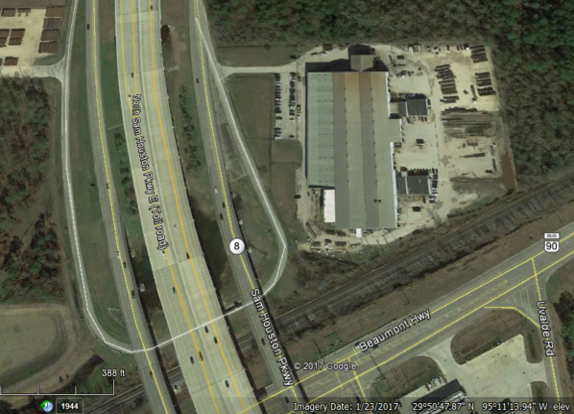

Industrial Tax Savings

| 2023 Assessment Value | $16,499,160 |

| 2023 Final Value | $12,083,230 |

| Market Reduction | $4,415,930 |

| Tax Savings | $101,335.93 |

| 2023 Assessment Value | $14,850,675 |

| 2023 Final Value | $12,850,000 |

| Market Reduction | $2,000,675 |

| Tax Savings | $44,123.14 |

| 2022 Assessment Value | $8,690,890 |

| 2022 Final Value | $7,500,000 |

| Market Reduction | $1,190,890 |

| Tax Savings | $28,798.78 |

| 2022 Assessment Value | $6,858,418 |

| 2022 Final Value | $5,851,302 |

| Market Reduction | $1,007,116 |

| Tax Savings | $27,555.97 |