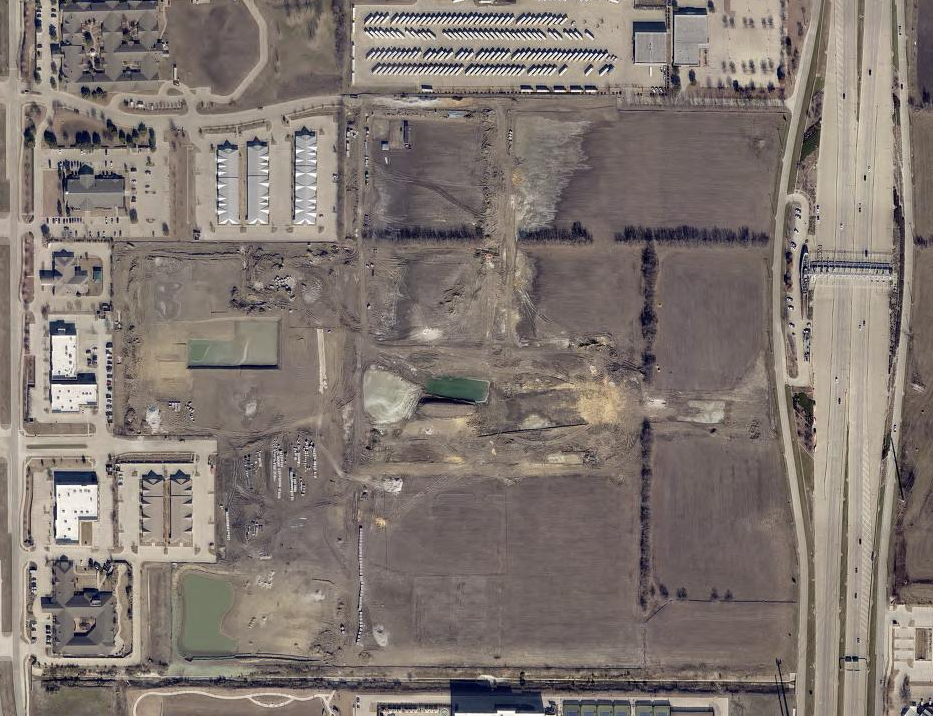

Land

| 2023 Assessment Value | $4,167,840 |

| 2023 Final Value | $925,238 |

| Market Reduction | $3,242,602 |

| Tax Savings | $89,524.95 |

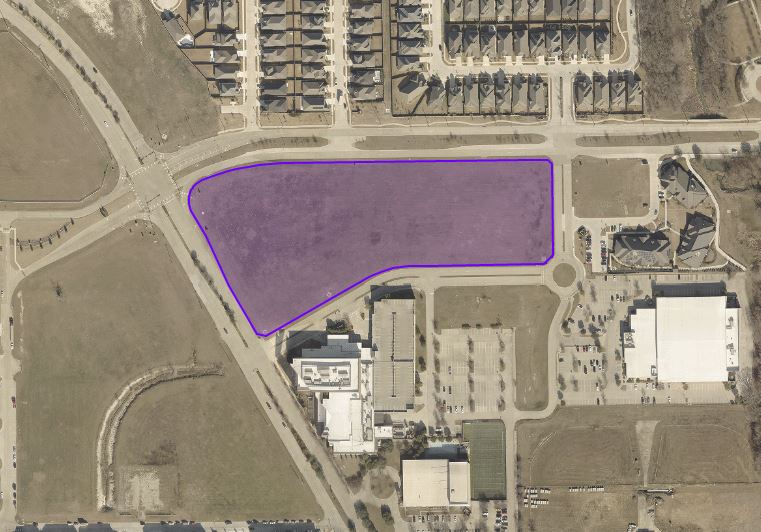

Land

| 2023 Assessment Value | $22,403,061 |

| 2023 Final Value | $16,711,846 |

| Market Reduction | $5,691,215 |

| Tax Savings | $43,950.42 |

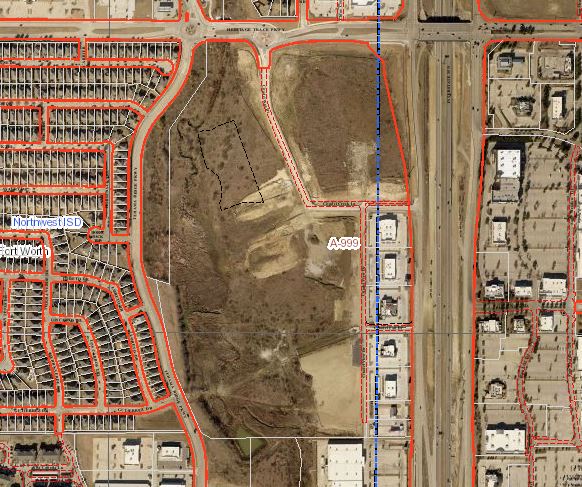

Land

| 2022 Assessment Value | $27,187,958 |

| 2022 Final Value | $12,303,222 |

| Market Reduction | $14,884,736 |

| Tax Savings | $289,788.89 |

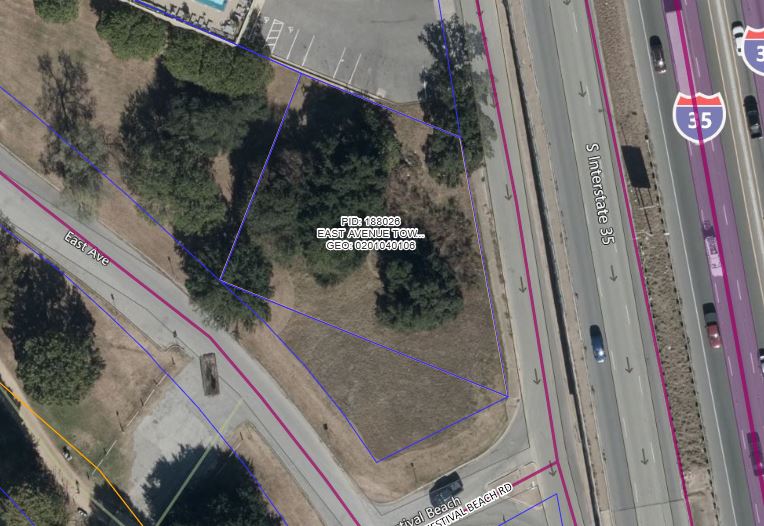

Land

| 2022 Assessment Value | $5,525,150 |

| 2022 Final Value | $3,907,071 |

| Market Reduction | $1,618,079 |

| Tax Savings | $34,849.61 |

Land

| 2022 Assessment Value | $17,062,125 |

| 2022 Final Value | $2,164,357 |

| Market Reduction | $14,897,768 |

| Tax Savings | $393,085.73 |

Land

| 2022 Assessment Value | $4,368,560 |

| 2022 Final Value | $3,000,000 |

| Market Reduction | $1,368,560 |

| Tax Savings | $29,789.15 |